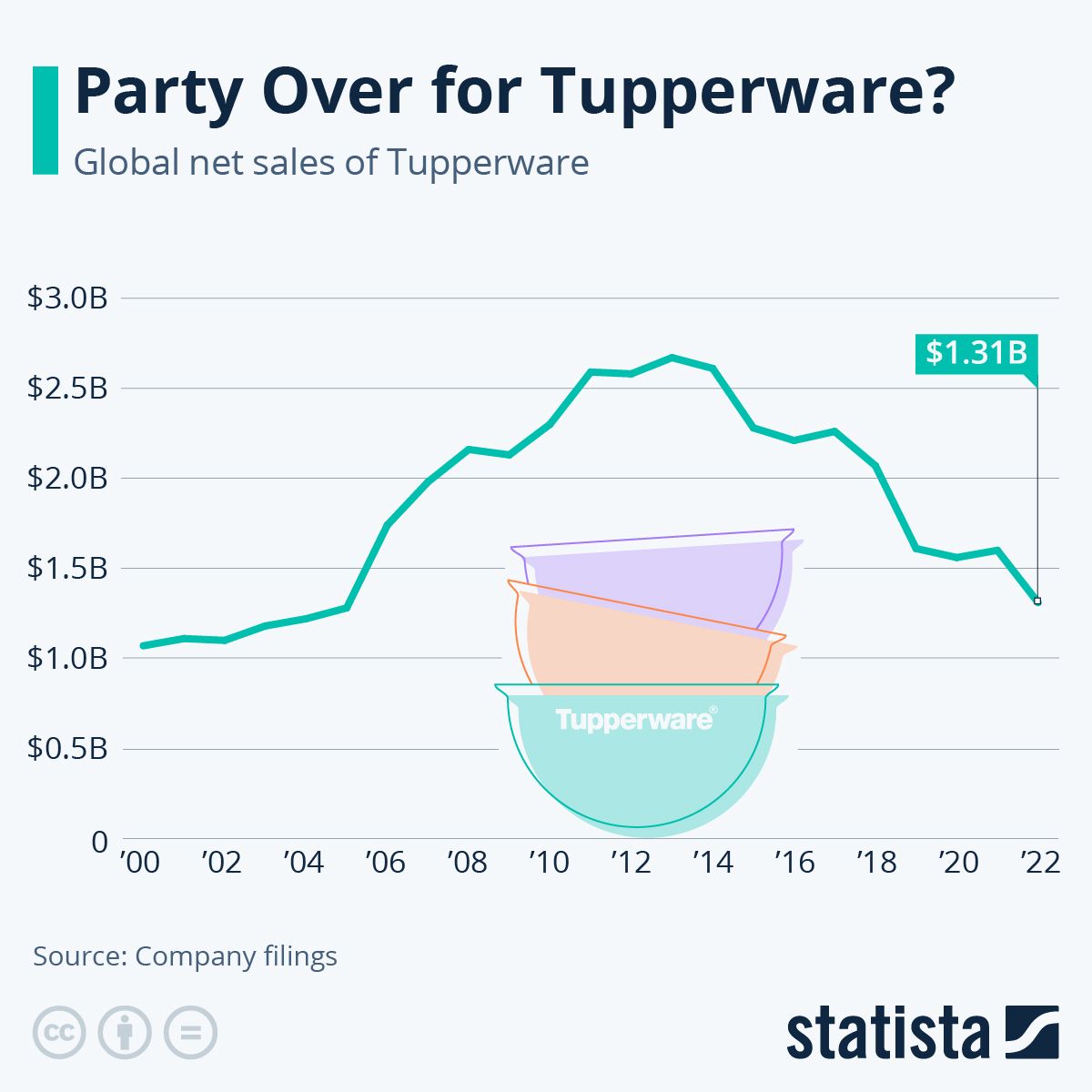

On Tuesday, Tupperware—an iconic brand that defined food storage for generations—filed for Chapter 11 bankruptcy. For a brand so culturally ingrained that its name became a noun, how did it fall so hard? The story of Tupperware's decline offers valuable lessons in innovation, distribution, and debt that business owners, both large and small, can learn from.

"The biggest risk is not taking any risk. In a world that's changing quickly, the only strategy that is guaranteed to fail is not taking risks."¹

The Rise of an Icon: Tupperware's Early Success

Tupperware's journey began with Earl Tupper, who created plastic products for gas masks during World War II. After the war, he pivoted to develop the famous "burpable" container that could keep food fresh by creating an airtight seal. Initially, these products struggled in retail, but Tupperware found its breakthrough when Brownie Wise, a part-time saleswoman for Stanley Home Products, took notice.

Brownie Wise, hosting a Tupperware home party. She often tossed a Wonderbowl full of grape juice around to show just how tight the seal was!

Wise recognized that women selling to women through in-home demonstrations was far more effective than store shelves. Her famous demo of burping the Tupperware lid like a baby created an emotional and practical connection, turning the product into a household name. Wise's insight—that women could sell to other women through trusted personal connections—became the foundation for Tupperware's legendary party model².

This model capitalized on the post-war suburban boom, where women gathered in homes to host Tupperware parties. These gatherings allowed for product demonstrations in a social, trusted environment. This grassroots, community-driven sales force helped Tupperware flourish and empower women, who had lost their wartime jobs, as independent sellers³.

The Turning Point: Failure to Adapt

Despite its early success, Tupperware's reliance on its party-plan model eventually became a liability as consumer behaviors shifted. By the early 2000s, e-commerce was on the rise, and consumers were growing accustomed to buying online. Tupperware was slow to move away from its in-home sales model, even as it began to lose relevance in a digital-first world³.

At the same time, concerns about plastic's safety—especially chemicals like BPA—drove consumers toward alternatives like glass and silicone containers. Competitors capitalized on this trend, offering products that were perceived as safer, more eco-friendly options, while Tupperware stuck largely to its legacy plastic products⁴. The hero of it’s product line - plastic - had become it’s achilles heel.

Though Tupperware eventually introduced BPA-free plastics, they didn't innovate fast enough. The company continued to rely on the party model, which became increasingly outdated, failing to capitalize on the emerging e-commerce revolution. In 2020 Tupperware reported as many as 3.2 million sellers across the world. As a result, the company missed opportunities to capture the attention of digitally savvy consumers, leaving them vulnerable to more agile competitors⁴.

Killing Your Darlings: A Missed Pivot

One of the biggest lessons from Tupperware's story is the necessity of "killing your darlings"—letting go of successful past models to make way for future growth. Tupperware failed to phase out both its plastic container as the hero product and its party model as the primary sales channel.

This reluctance to evolve is like Kodak's infamous missed opportunity with digital photography. Kodak invented the first digital camera in 1975 but chose not to develop it, fearing it would cannibalize their lucrative film business. This decision ultimately led to Kodak's bankruptcy in 2012⁵.

In contrast, consider Netflix. Initially a DVD rental-by-mail service, Netflix recognized the potential of streaming technology early on. They made the bold decision to pivot their entire business model, eventually becoming the streaming giant we know today. I was an early user of Netflix (Qwikster anyone?) and remember what a coup it was that they would kill the DVD business in favor of the streaming business. But this willingness to "kill their darlings" — their original DVD rental business — allowed Netflix to stay ahead of the curve and dominate the market⁶.

Had Tupperware shifted earlier to glass or silicone as their flagship product, they could have embraced health-conscious trends. Similarly, they could have phased out in-home parties and focused fully on e-commerce and digital marketing.

A brand just as old and established as Tupperware that has navigated this well is Stanley. Founded in 1913, Stanley was the company that actually spurred Brownie Wise into home sales. They made a range of products, but focused on a stainless-steel insulated thermos (Thermos is another brand that became a noun). By the late 2010s, Stanley was still around, but had revenues near $70M a year. But then, a group of women found and loved the Quencher water cup. Not finding a way to get it into the hands of their blog readers, they made a bulk purchase of Quenchers themselves, set up a Shopify store, told their readers and sold 5,000 units in days. And then they did it again, but sold out in an hour. Finally they got the ear of Stanley's leadership, which led to a strategic pivot that embraced the modernized method of women selling to women online. Posts about the cup went viral. Sales 10xed, soaring to over $750M a year⁷. This same principle, applied digitally, could have revived Tupperware's sales.

Had Tupperware recognized these shifts earlier, they could have captured market share in emerging digital sales channels and health-conscious products. But by holding onto their outdated models, they missed a critical opportunity to evolve.

The Role of Debt: The First Nail in the Coffin

In addition to missing the product and sales pivot, Tupperware made another critical mistake: using debt to cover operating expenses instead of funding innovation or digital transformation. Beginning in the mid-2010s, Tupperware started borrowing heavily to keep the company afloat rather than using that capital strategically for growth.

From Tupperware annual reports, 2018-2022. Created by ChatGPT4o

Debt, when used properly, can fuel innovation. But in Tupperware's case, it was a stopgap measure, delaying the inevitable⁸. By 2024, the company had accumulated unsustainable debt, leaving little room for investment in new products or the digital infrastructure needed to remain competitive. This inability to restructure their business or make bold investments led to financial distress - and ultimately Chapter 11⁸.

In contrast, consider how Amazon strategically used debt to fund its Amazon Web Services (AWS) infrastructure. This investment in cloud computing technology not only created a new revenue stream for Amazon but also revolutionized the entire tech industry⁹.

Lessons: Principles to Learn From

For business owners, Tupperware's story offers several valuable lessons:

1. Product + Distribution = Growth: A great product is not enough. Success comes from matching the product with the right distribution model. Tupperware thrived when it paired its innovative container with the right sales model—women selling to women However, when that method became outdated, they failed to adapt fast enough¹⁰. The principle here still exists, as we saw with the surge for Stanley cups, but the method has dramatically changed.

2. Kill Your Darlings: Sometimes, letting go of past successes is necessary for future growth. Tupperware's hesitation to phase out its plastic containers and party model ultimately led to its decline. Businesses need to evolve, even if it means killing what's still working today¹¹.

3. Use Debt Strategically: Debt should fuel growth, not just sustain existing operations. Tupperware used debt to patch operational gaps instead of innovating or pivoting to new markets. This led to a financial burden that made it difficult to invest in the future⁸.

What's Next for Tupperware: Strategic Steps to Reignite the Brand

Although Tupperware is facing a ton of challenges, Chapter 11 bankruptcy offers a chance for restructuring and revitalization. Here are some strategies Tupperware could adopt to turn things around:

1. Reignite Their Hero Product Online: Tupperware still has strong brand recognition. The company can reignite its hero product—potentially a new version of their airtight containers but with modern improvements, like a glass container with a Tupperware-style lid. This would tap into consumer concerns around food safety while maintaining Tupperware's brand strength. This could be done with an existing brand in order to leverage established supply chains for glass or silicone products.

2. Kill the Party Model and Pivot Fully to Digital: The party model is outdated. Tupperware should fully embrace e-commerce, phase out in-home parties, and give consultants tools to transition into affiliate marketing or social selling on platforms like Instagram and TikTok. A clear digital-first strategy would modernize the brand and meet consumers where they are today¹².

3. Strategic Debt Restructuring: Tupperware must negotiate to reduce its debt burden, allowing more capital to flow into product development and marketing. Future borrowing should be directed at growth and innovation, not sustaining outdated models¹³. This will most likely happen through a PE take-private. Tupperware has struggled to refinance their existing debt already, which led to a number of missed reporting cutoffs.

4. Launch a Digitally Native Sub-Brand: Tupperware could create a digitally native sub-brand targeting younger generations, but using their existing manufacturing capabilities. This sub-brand would embrace millennial and Gen Z vibes, like eco-friendliness and convenience, while benefiting from Tupperware's legacy infrastructure. It wouldn’t carry the brand weight of the Tupperware name, so would be lighter and freer to move online. This is by far the riskiest though, and this type of play rarely works to reinvigorate a brand. In reality this should have been done 10 years ago.

A Path Forward

Tupperware's story serves as a powerful reminder that no business is too big to fail—or too established to reinvent itself. By focusing on a hero product, embracing e-commerce, restructuring their debt, and launching a digitally native sub-brand, Tupperware may be able to connect with new generations and thrive once again. The key lies in killing what's no longer working and embracing strategies that align with today's market.

As entrepreneurs, we have to ask: What are our "Tupperware parties"? Is there anything we need to kill to continue to thrive? By continuously innovating, being willing to let go of outdated models, and using financial tools wisely to fuel growth, we can position our businesses last far into the future.

Remember, as Zuckerberg said, the biggest risk is not taking any risk at all. In a world that's changing rapidly, adaptation isn't just beneficial—it's essential for success.

Catch you next week!

-Nate

P.S. I am holding a 1hr profitability webinar next week for business owners who are looking to sustainably increase their profit by 50%. I’ll teach the principles I use when helping clients increase their profit. No “secrets” just proven, actionable, simple strategies. Sign up here.

Simple Strategies is written by Nate Pinches.

He did an MBA so you don’t have to, has consulted for over 50 CEOs and has worked on AI projects for 6 years.

He lives with his wife and kids in Okinawa Japan.

not an AI.

Citations: