I was surprised to hear that the CEO of Starbucks was out of a job. He was handpicked by Howard Schultz. He’d been in the role for a little over a year. He’d just become an actual Starbuck’s Barista!

But Starbucks stock jumped 24% when it was announced that Brian Niccol, the CEO of Chipotle was the new pick.

“What the heck is going on at Starbucks?”

I looked for articles to find out and got a lot of frothy nothingness. My main question was “What is the fundamental issue Starbucks is facing?” It wasn’t answered anywhere.

So I read more than 40 articles and sorted through 4 years of Starbucks financial reporting to figure it out so I could share it with you.

The board was right to switch.

tl;dr - Starbucks has problems with decreased consumer spending, irrational competition in China, extraordinary drink customizations and brand strategy.

They need to slim down in-app customizations, offer faster drink options, franchise Starbucks China, and refocus the mission back on high quality coffee. Laxman Narasimhan’s strategy did not address these issues, which is why he was fired.

Niccol has direct experience with each of these problems. He was a really good pick.

This article is a shift from my usual short-form ones for small business owners. I had a wonderful summer away and this was in part a project to restart my brain.

I spent about 30 hrs researching and writing for it.

It’s long - probably a 30 minute read. If your email provider cuts the length off, you can also read it on the website here.

I hope you enjoy! Forward it to a friend who might be interested!

- Nate

Table of Contents

Margin Compression

The most pressing issue for Starbucks is margin compression.

What is margin compression?

It’s when you make less money for the same effort as you did in the past. Remembering that, “Revenue - Cost = Margin” and “Price x Volume = Revenue”, if sales volume drops, but cost increases, margin compresses.

Or if revenue is up but cost as a percent of revenue is up, margin is compressed.

Both are happening to Starbucks.

Cost is up.

Because of a variety of reasons (inflation, a wet season and high bean prices, shipping) it’s more expensive for Starbucks to do business than a few years ago. Coffee beans cost more, dairy is up, labor costs are up… and prices at Starbucks are hitting the limit on what consumers will spend.

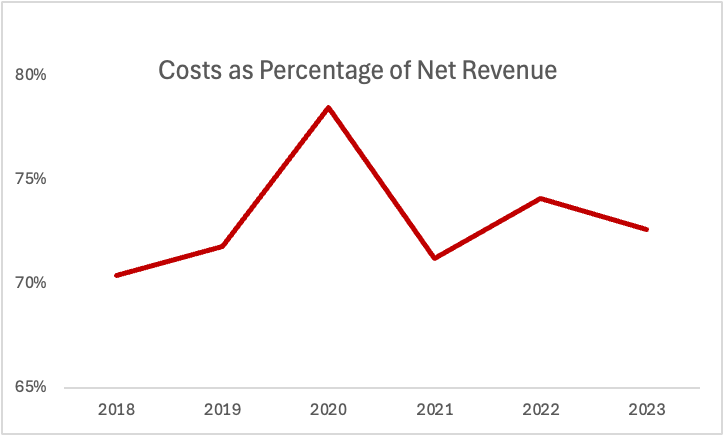

Starbucks reports their cost as Store Operating Expenses, which includes labor and rent (40.9%) and Product and Distribution, which includes things like coffee beans and milk (31.7%). Added together this gives a total cost for 2023 at 72.6% of total revenue. Over the last 6 years, total cost to operate as a percentage of total revenue has gone up from 70.4% in 2018 to 72.6% in 2023. The margin is being compressed.

Starbuck’s Cost as a Percentage of Revenue. Cost is rising faster than corresponding revenue, we should see this trending downward.

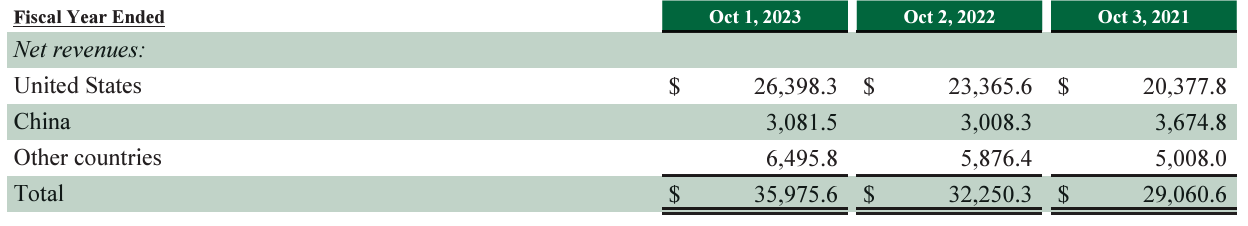

While a 2.2% change cost as a percent of net revenue sounds small, with $36B in revenue in 2023, that represents $792M in margin compression, or lost profit. There was a massive surge in cost as a percentage of net revenue during COVID, but that dropped to normal rates in 2021. From there it has steadily increased. For a company the size of Starbucks, this should steadily decrease as new economies of scale are unlocked.

Add to this larger trend two quarters of declining sales in Q2 and Q3 of 2024 and it becomes a management crisis, not just a concern.

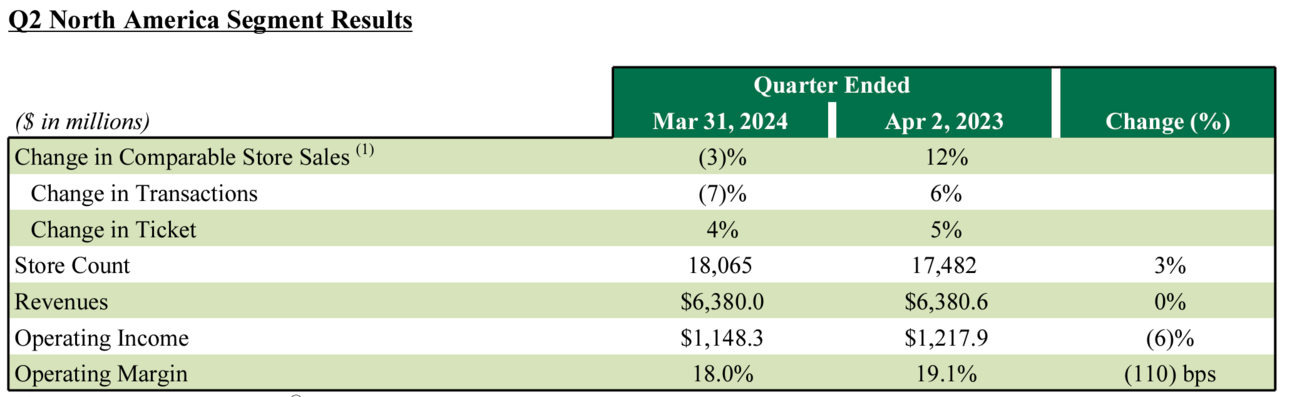

“Our Q2 total company revenue was $8.6 billion, down 1% year-over-year. Our global comparable store sales declined 4% year-over-year, driven by a negative 3% comp growth in North America, led by declining traffic and a negative 11% comp growth in China. Our global operating margins contracted by 140 basis points to 12.8%, and our overall earnings per share declined by 7% to $0.68.”

That is a rough investor update.

When you look closer at the comparable store sales for North America, there’s further cause for concern. In Q2 we see that Transactions are down 7% compared to the same time period the year prior. Importantly, change in ticket is up 4%, but store sales are still down 3%. This means all of the “increase average order value” strategies are being used, but it’s not countering a change in consumer spending.

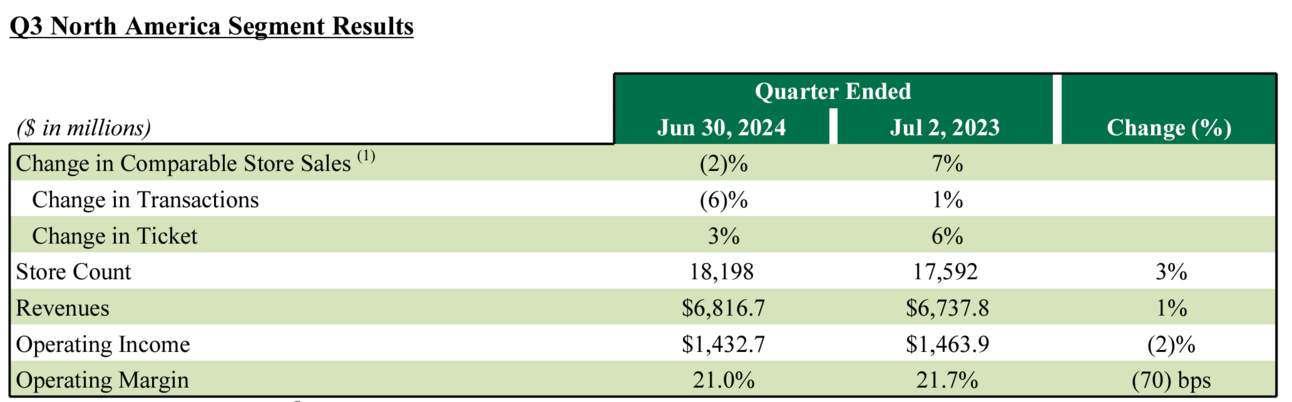

In the below tables, which were taken from Q2 and Q3 reporting, the “Change in Transaction” and “Change in Ticket” are most important.

This drop in same store sales means that consumers are pulling back in what they’re spending. It’s not a new store that is still gaining traction, it’s an established location that is losing revenue. Bad news.

“But in this environment, many consumers have been more exacting about where and how they choose to spend their money, particularly with stimulus savings mostly spent.” - Q2 2024 Earnings call, Laxman Narasimhan, CEO

In Q3 of 2024, we see the same problem again. This isn’t just a blip on the radar, it’s a downward trend. Thats REAL bad news.

Consumer Spending is Down

Why is consumer spending down? You can only raises prices by so much.

There are many ways to increase AOV (Starbucks is the king of charging for flavor pumps) but eventually you’ll cross a consumer’s price/value ratio. If the price gets too high, they’ll start substituting something else.

Each consumer has a different price/value ratio. Changing economic circumstances won’t necessarily change consumer tastes - a coffee drinker won’t turn into a tea drinker because of a recession - but it will force consumers to change their price/value ratio. They’ll look for a cheaper option. People who used to get Starbucks will make coffee at home, or try Dunkin, or Luckin.

The trend of substitution is easiest to look at in the beer industry, where major brands are owned by public companies and publish their sales metrics. During recessions sales volumes shift because consumers start replacing their favorites with cheaper alternatives. Beer drinkers don’t stop drinking beer when they have less money, they just buy cheaper beer.

A graphic from a 2009 WSJ article on beer consumption during the Great Recession.

Interestingly, the shift can sometimes stick, with consumers growing to like their new, cheaper alternative to the more expensive option and never go back. They might not value the old product less, but they value the new product more.

This is a very consultanty graph, but the point is once you try a Dunkin Frozen Coffee, you might not think that a Frappucino mocha latte is worth the extra $3.

This risk of substitution is a serious problem for Starbucks. In the image above, they would be “Product A”. Drinks often average $7 or more, with a high-value/high-price ratio. You can compare this to Dunkin, where a comparable drink averages $4, or Luckin Coffee in China where drinks are $2.50.

It’s questionable whether the US is going into a recession, but most recession metrics don’t count for inflation among consumer staples - things you need or like to buy on a weekly basis. Those items (bread, gas, chicken, ground beef) are tracked in the Consumer Price Index. It has gone up dramatically in the last 4 years.

“But in this environment, many consumers have been more exacting about where and how they choose to spend their money, particularly with stimulus savings mostly spent.” - Q2 2024 Earnings call, Laxman Narasimhan, CEO

The official word may be that the US is not in a recession, but customers are definitely spending less. And when they do spend, they want it quickly.

So many choices, so many calories

There are 170,000 ways to make a drink at Starbucks. While the Starbucks app, where nearly 60% of orders are placed now, has significantly boosted the business. Through the app, consumers can change the number of pumps, shots, blends, shakes, etc. This has been great for business - personalization increases the feeling of ownership, which makes people come back for more. However, taken to the extreme, which Starbucks seems to have done, this means extraordinary complexity for completing orders.

If you zoom waaaay in, it really is 170,000 cups. 10,000 is still a ton.

In a process improvement, you always start at the beginning to understand how you can limit variability. If you can enter a process with fewer inputs, the statistical likelihood that you’ll make it through according to the standard is higher. Simply, it’s easier to deliver a high quality product when you have 10,000 variations, rather than 170,000.

The challenge here is again twofold. First you have the wait-times and re-work added with highly complex drinks. Second you have the sugar.

This barista just makes videos of bussin drinks at Starbucks and has 1.8M followers on TikTok. No cap.

Gen Z loves complicated, cold drinks. They make TikToks about them. A lot of TikToks. In 2024 Q3 remarks, Mr. Narasimhan reported that 76% of the quarter’s beverage sales were cold. There’s some seasonality since their Q3 is summer in the US, but 76% of sales is a lot. Most cold drinks have an insane amount of sugar in them.

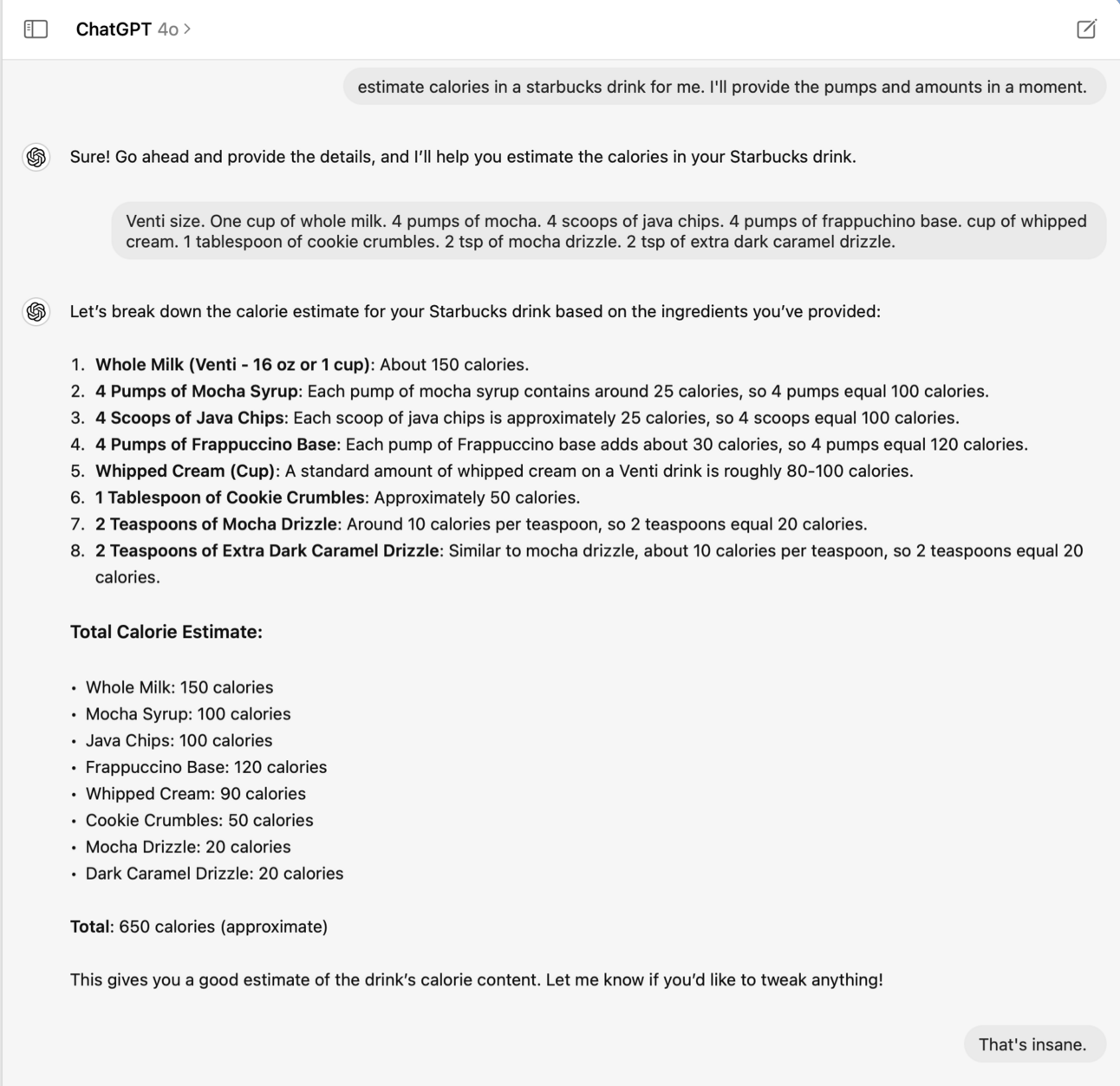

It’s not uncommon for a Venti drink to have 8 pumps of sweeter in it. And whipped cream with a chocolate. Blended Frappuccino’s often have 60 grams of sugar and over 500 calories.

That’s not a coffee. That’s three scoops of ice cream melted and poured in a cup. As consumers increase their understanding of what processed sugars do in our bodies, will they pull back on these kinds of drinks? I definitely have (but I’m an aging millennial).

Which leads to the second problem - more existential than the first - is Starbucks a coffee company or an ice cream company?

And if they are a coffee company, are they still in that “High quality, high price” quadrant? But first, lets look at China.

China

Geopolitics, China and Taiwan

Chinese leader Xi Jinping has been vocal on the reunification of Taiwan with China, potentially soon. Taiwan is overwhelmingly opposed to this. The US has been deliberately unclear about how it would respond if China used force to take Taiwan. Some predict war. I hope not.

In the context of a business analysis it’ meaningless to game out this scenario. War with China, the only other true peer of the USA, would be horrendous however it might happen. We should work to avoid it. Were it to happen, not only would companies with a stake in the Chinese economy suffer, all the global economy would tank. A $3B write down of the Starbucks China business would be swift in a wide-scale conflict. Because of that, I won’t consider the potential business impacts of a conflict with China, but instead will focus on how Starbucks might compete in China with a new, saturated market for coffee.

China! Yum!

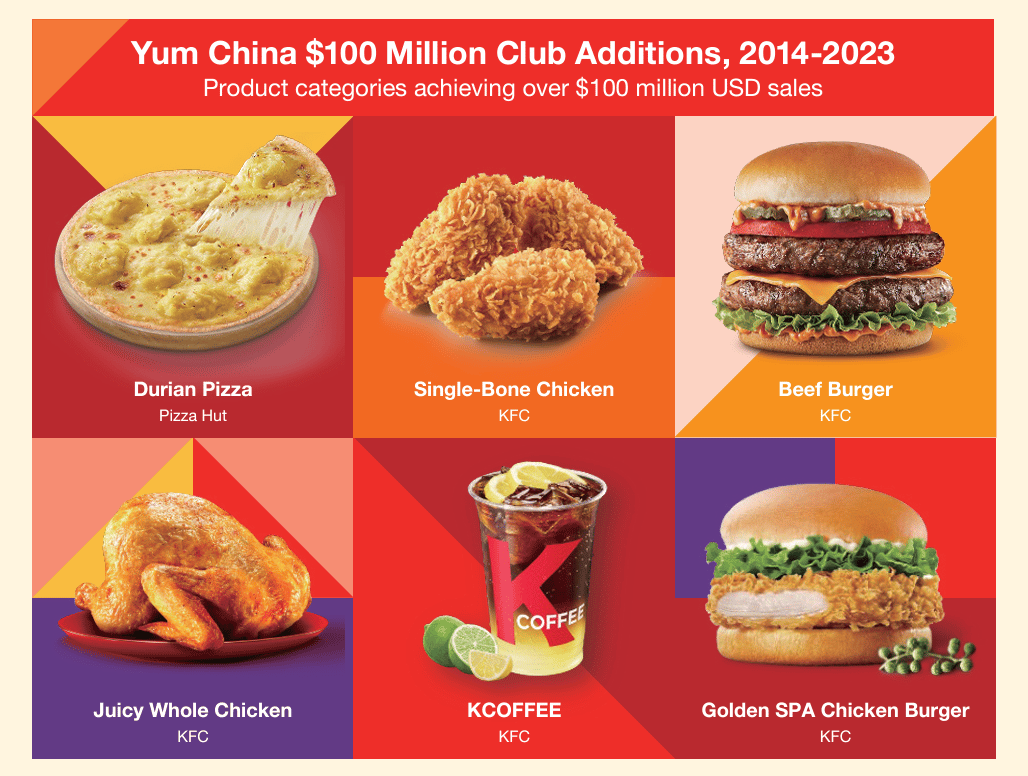

In 2015, Yum!Brands had a problem. Yum! owns and runs KFC, Taco Bell and Pizza Hut restaurants throughout the world. Since the late 1980s, Yum! had been steadily growing it’s footprint in China. KFC is really popular in Asia and Pizza Hut is fancy in China, often reserved for date nights.

But in 2015, an activist investor took a 5% stake in Yum! and forced talks to divest the China business. Sound familiar? Elliott Capital Management has taken a “sizable” stake in Starbucks and has requested a seat on the board. They welcomed the appointment of Mr. Niccol. Coincidence? I think not.

In 2015, Yum!Brands had over 7,000 restaurants in China, with an annual revenue of $6.8B. But the business was volatile. Chicken suppliers had a spate of egregious food safety violations in 2014, that led to a brief whole company shutdown in China. Those issues dragged revenues for Yum!Brands and caused a drop in market-cap.

Basically, the China business was too risky for the US business.

So, after having their hand forced, Yum!Brands (YUM) spun off Yum!China (YUMC) with an IPO on the NYSE in 2016. Yum!China continues today as a single owner of the rights own to franchise Yum!Brands restaurants in China. They also pay a yearly 3% revenue fee to Yum!Brands. They also shifted to a franchise model rather than company-owned stores to attract new investment capital within China.

2016 | 2023 | |

|---|---|---|

KFC | 5,200 | 10,296 |

PizzaHut | 1,700 | 3,312 |

Others | 614 | 1,015 |

Total Revenue | $6.8B | $11B |

It’s worked well. By 2023 Yum!China has nearly doubled in size and revenue since 2016 and has added a number of high revenue menu items that don’t exist elsewhere. The ability to attract local capital to fund growth through franchises and the freedom to innovate with local ingredients has been helpful for American brands in China.

Starbucks isn’t battling food food safety concerns in China (at the moment) but there are other issues. A flooded coffee market with irrational competition is high among them.

Irrational Competition in China

Starbucks opened their first store in China in 1999. The market hoped to be a major driver of growth for Starbucks - and in many ways has been. They effectively pioneered a coffee culture in a tea-drinking market and have established the brand as a premium product.

In 2023, China accounted for ~12% of Net revenue for Starbucks at just over $3B. There are now 6,500 stores in China and a major roasting and warehousing facility. All the stores in China are company owned. (There are 17,800 stores in the US)

Numbers reported in millions.

While there has been growth in China, competition has gotten fierce in recent years, irrational even.

Luckin and Cotti are in a fight.

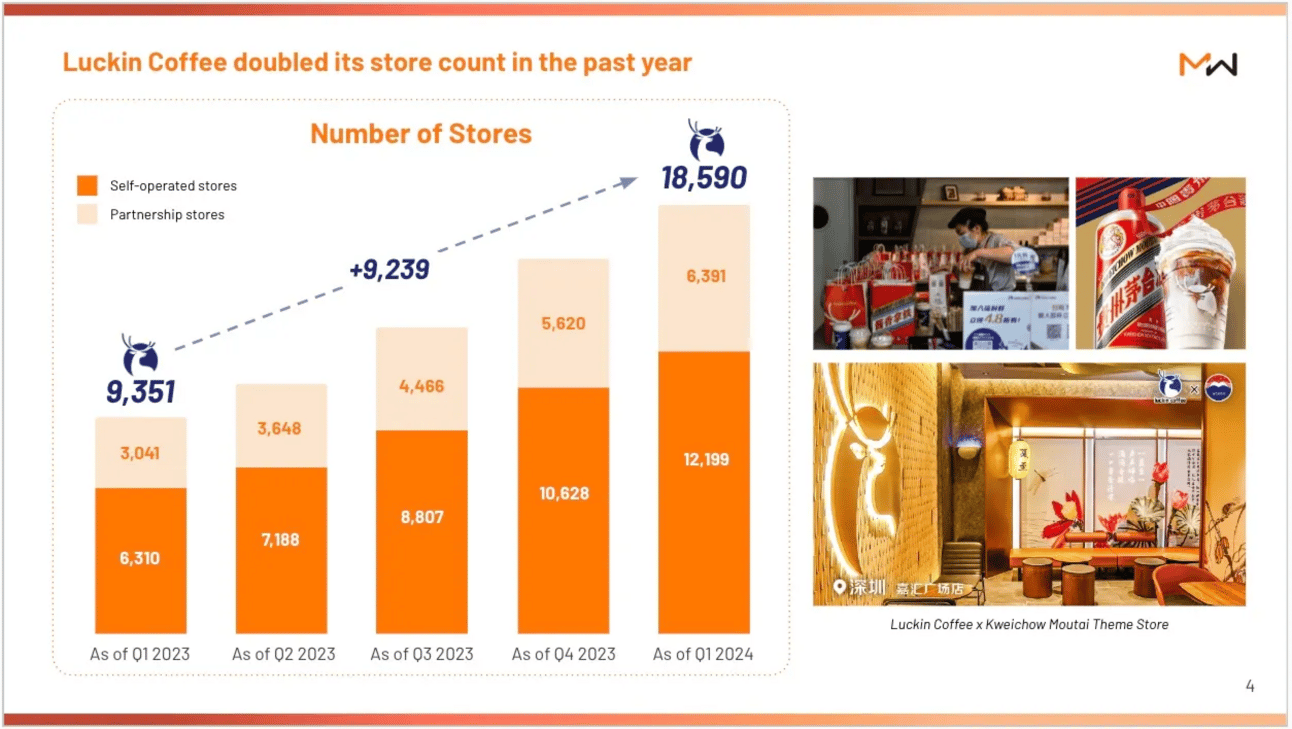

Luckin Coffee was founded in 2018 to take advantage of a growing coffee-drinking culture. They raised and invested aggressively in their local market, intending to become the default option for coffee. All orders at Luckin are placed through their mobile app, and most stores are takeout only. Their growth has been fast but turbulent. In 2020, Luckin execs were involved in wide-spread accounting fraud and the stock was forced to delist from the Nasdaq. Despite this sales have steadily increased, beating out Starbucks in China in 2023. Their stores operate with efficiency at the forefront, drinks can only be mobile ordered, and speed is key in deciding what new drinks get offered. They run discounts often and price at about 2/3rd of Starbucks drinks. Luckin opened their 10,000th store in June of 2023.

In June of 2024, they opened their 20,000th store. They’ve only been open for 6 years! That’s aggressive!

Add to this mix, Cotti Coffee and the competition for coffee drinkers in China gets really hot. Cotti Coffee was founded in 2022 by former execs from Luckin. They use similar strategies - mobile order only, drink innovation based on data from users, pick-up only stores.

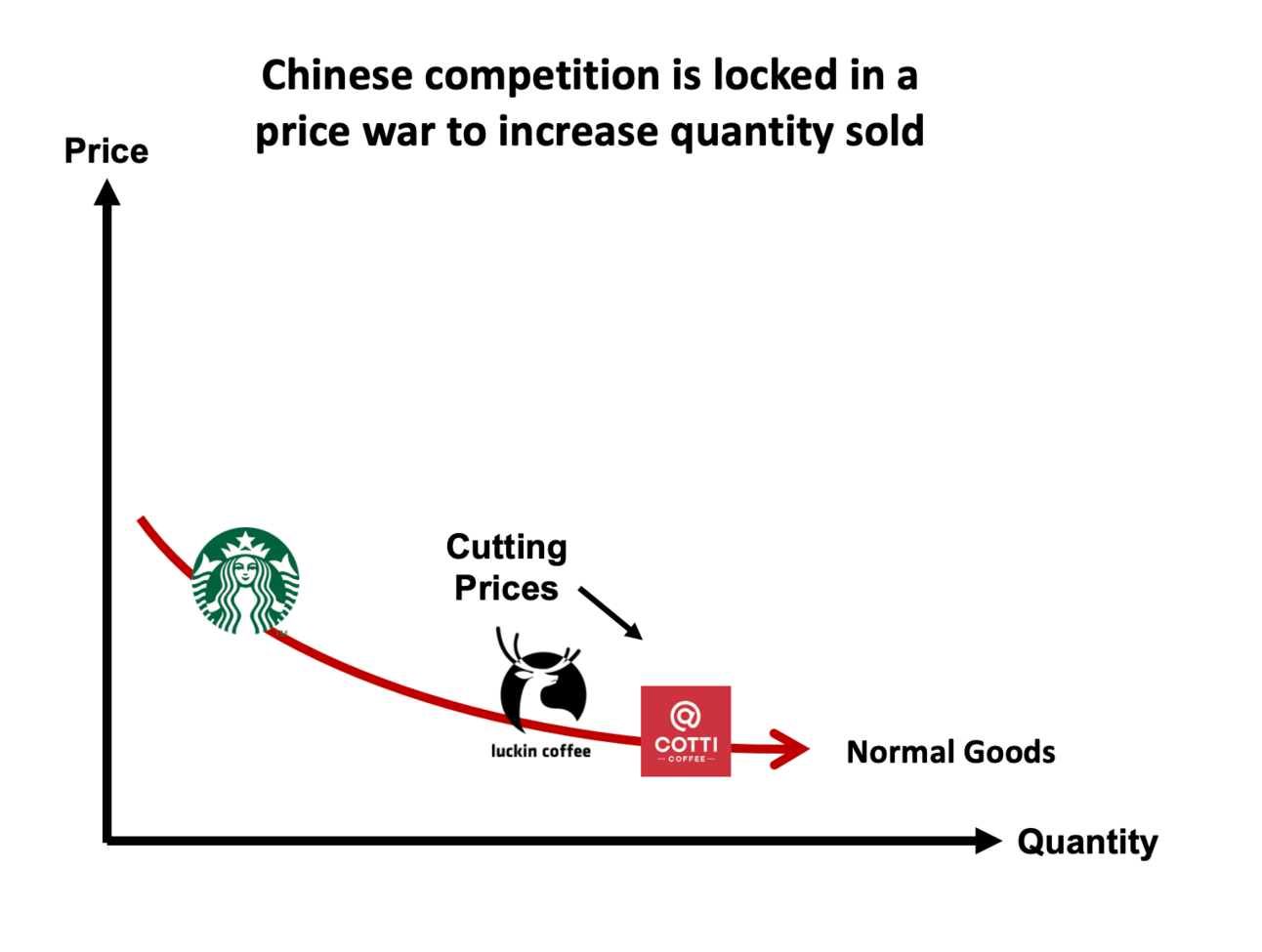

In less than 2 years Cotti Coffee has already opened 6,000 stores! After 24 years in the country, Starbucks has basically the same number of stores as a 2 year old competitor. To win new customers and lock in their spot in customers routines, Luckin and Cotti have been locked in a price war, with Cotti undercutting Luckin at 9.9 yuan ($1.40) per drink. This is about a third of the price of Starbucks.

When competitors lock each other in a price war, everyone suffers. Competition becomes irrational when a price war is combined with extraordinary investment in growth. Both Luckin and Cotti have been growing at a rate that is not connected to their profitability. For Starbucks to keep up, they would need to continue to invest at a rate comparable to these two, with some estimates near $400M a year. If they don’t, they could quickly become a much smaller, niche player rather than the dominant force in China’s coffee market.

So what can they do?

Back to Veblen

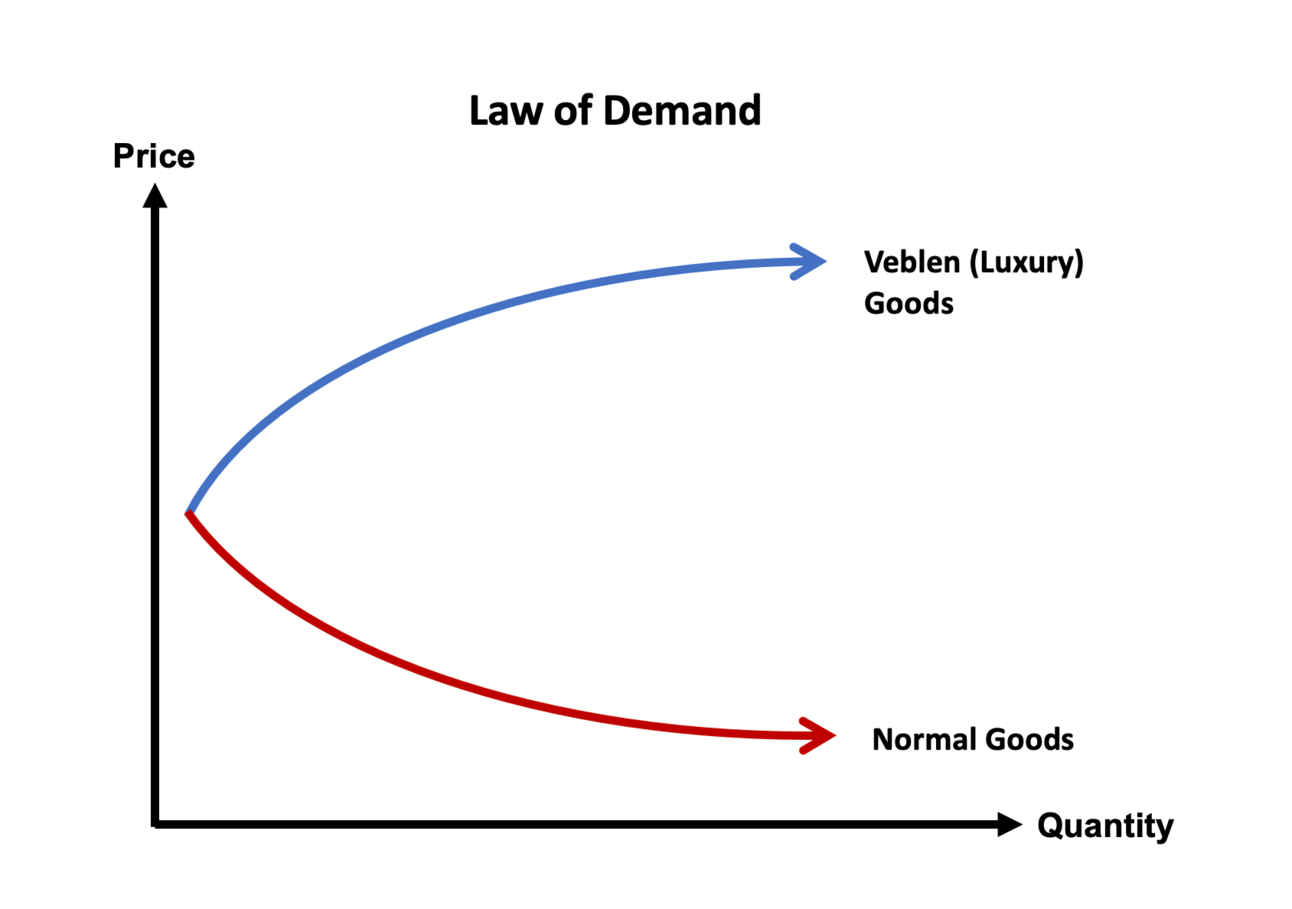

To understand what Starbucks needs to do, it’s helpful to think quickly about economic theory. The Law of Demand as a fundamental principle in economics. As the price of a good or service decreases, the quantity demanded by consumers typically increases, and vice versa. However, the way this principle plays out can vary depending on the type of good.

Normal Goods: Demand increases as income rises, and more is bought when prices drop (e.g., meat, cheeses). Most goods we think about are Normal.

Inferior Goods: Demand decreases as income rises, with higher demand when prices drop (e.g., Busch Lite, instant coffee).

Veblen Goods: Demand increases with price rise due to their status symbol appeal (e.g., Ferraris, Rolex watches).

(There’s a 4th, called Giffen Goods where demand increases when price increase because there are no affordable substitutes ( rice, potatoes, milk) but we’re going to ignore those now).

What’s the primary difference between Veblen and Normal goods? Exclusivity, Quality, and Status.

Ferrari is a Veblen brand. There are few Ferraris for purchase. You join an exclusive club when you buy one. Build and drive quality is second to none. It is a luxury purchase and everyone knows it - both the people buying and the people looking.

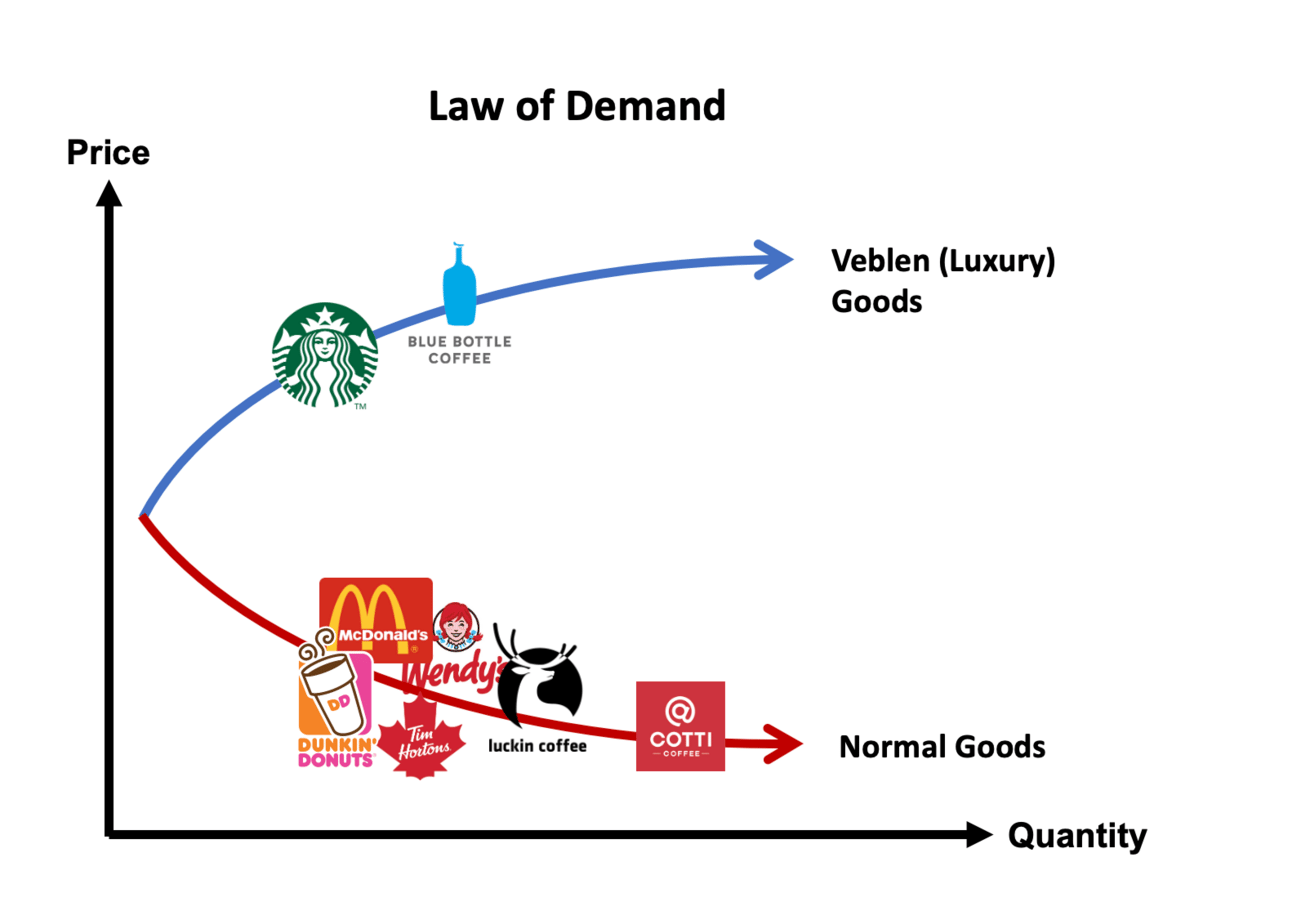

Luckin, Cotti, Dunkin, McDonalds, Wendy’s, Tim Hortons…… all these companies think of coffee as a normal good. They cluster together on price and sell based on location, speed and discount. If it’s open, “it’ll do”.

Starbucks and Blue Bottle, on the other hand, position coffee as a Veblen Good. Holding their cup show’s you’re capable of luxury purchases.

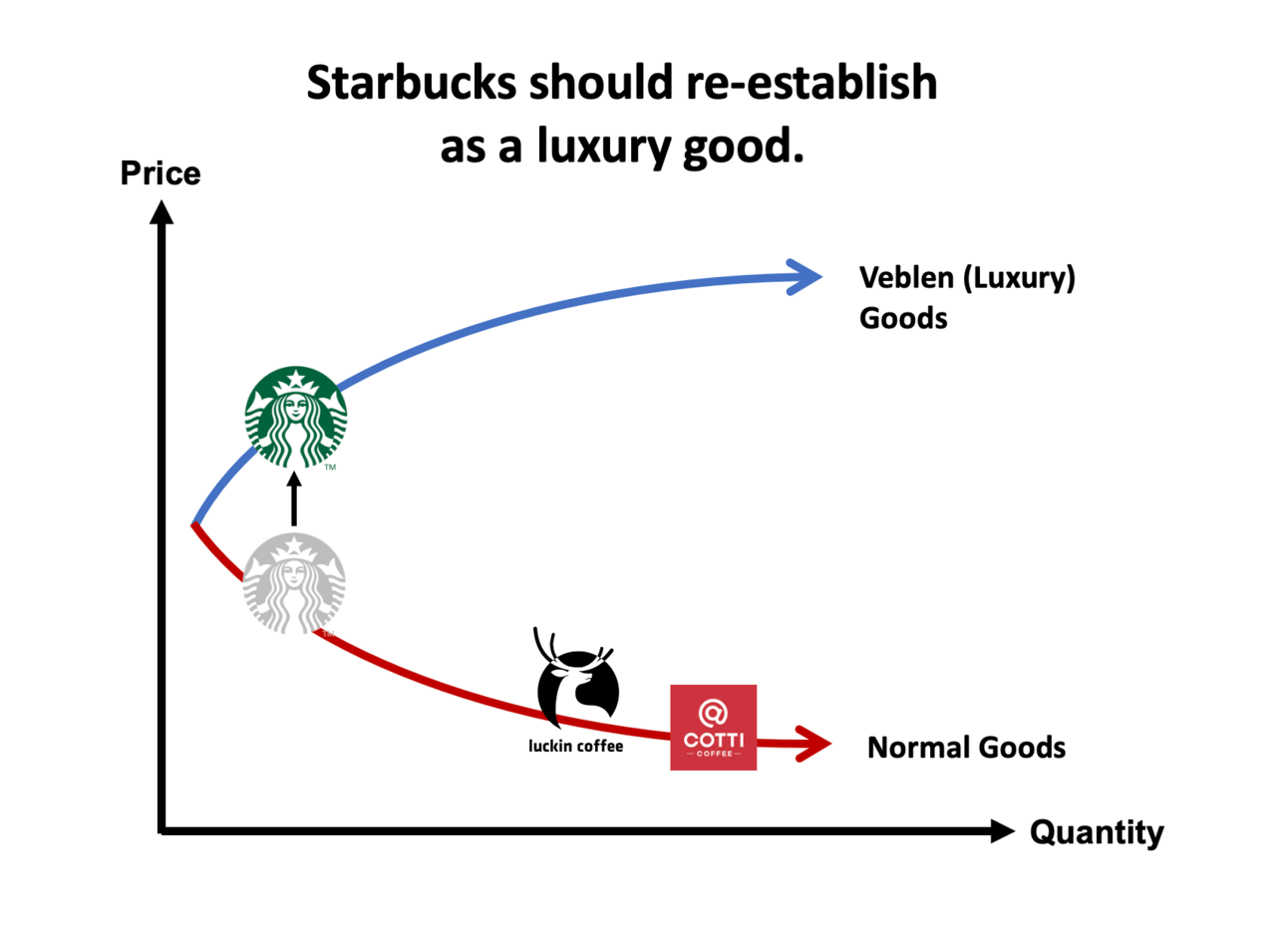

In China, Luckin and Cotti are both positioning themselves as Normal Goods providers. They are fighting each other on price and availability. Both brands are highly discounting their products and compete on efficiency with very small store fronts and native mobile ordering. Starbucks could be tempted to join this price war and lower prices to increase overall sales. That’s a fool’s bargain.

Rather than cutting prices, Starbucks should re-establish their brand as the most-available, Veblen coffee brand in China. The brand of Starbucks is very strong - people recognize it the world over - but the image is slipping. If drinks are mostly sugar, does the coffee matter? Where has the quality gone?

A bad mission - and strategy to match

Starbucks first opened in 1971. It started as a local coffee roaster in Seattle, before a sale to Howard Shultz in 1987. It grew steadily until an IPO in 1992, when it had 142 stores. Just prior to IPO, the first mission statement was created.

“Establish Starbucks as the premier purveyor of the finest coffee in the world while maintaining our uncompromising principles as we grow.”

This commitment to the finest coffee allowed Starbucks to command a high price. It used 100% Arabica beans, rather than the cheaper Robusta used by fast food chains. High quality beans, precision roasting techniques combined with a high quality service from baristas led to solid positioning in the upper right quadrant of that “price/value” ratio graph. High perceived price, high perceived value.

Starbucks was a luxury good among coffee providers.

But, cold drinks took off for Starbucks. The Frappucino has had extraordinary popularity and consumers showed they were ready to pay for pumps of flavor or extra shots. To include this new tendency among consumers, the mission was changed in 2008 and then again in 2023.

“To inspire and nurture the human spirit – one person, one cup and one neighborhood at a time.”

“With every cup, with every conversation, with every community – we nurture the limitless possibilities of human connection.”

Seriously, what does that mean. It was written completely in MBA-consultant-jargon; meaningless fluff to fill a slide. What the heck does “limitless possibility of human connection” mean for a company that sells coffee?

The new missions suggest two things.

Coffee is not the focus.

Starbucks is a corporate, mass-market company that sells a normal good (for every cup, every community).

Is there anything in these mission statements that says “Starbucks” and not Budweiser or Pepsi? No mention of coffee, no mention of quality, or even a tangible vision.

Mission statements are often a castoff; Most employees don’t know them, consumers certainly don’t. But they do direct the strategy, which is what really defines the identity of a company.

In November of 2023, a few months after the rollout of the new mission, former CEO Laxman Narasimhan announced the new strategy. “Triple shot with two pumps” (it was actually called that.)

This is the reason why Mr. Narasimhan was canned.

The Triple Shot strategy he offered:

Elevate the brand - through better run stores, growing the portfolio with more purpose-defined stores and accelerated renovations, and driving further product innovation.

Strengthen and scale digital - by doubling its 75M global Starbucks Rewards Members within five years and expanding digital and technology collaborations to elevate the partner and consumer experience.

Become more global - by accelerating store expansion to 55,000 globally by 2030.

Two Pumps:

Unlock efficiency - to generate $3B in savings over three years – with $2B outside the store – to deliver returns to shareholders through margin expansion and earnings growth.

Reinvigorate the partner culture - through the rollout of the mission, promises and values and through continued investments in the partner value proposition across the partner experience.

The difficult thing about business strategy is that there isn’t a right answer - there’s just a better answer. Pursuing efficiency is a good aim. But you can pursue it in the wrong place. Elevating the brand is great - but what is the focus?

Two quarters of declining sales later, and none of this strategy impacts the consumers limited spending dollars, competition in china or the long waits created by an insane possibility of orders. But there was no change in tack, just “it will take time to work this out”. Unfortunately for Mr. Narasimhan, that wasn’t good enough.

Mr. Niccol doesn’t need my advice, he’s worked on problems like this before, at TacoBell and Chipotle. But, if I were close to the board room, this is what I’d be focused on.

What Starbucks needs to do

1. Elevate Coffee Quality

Starbucks needs to return to its roots as the premier purveyor of the finest coffee in the world. The focus should shift back to quality, moving away from the recent trend of commoditizing sugary drinks. Customers need a reason to view Starbucks as a luxury brand rather than just another option in the market. The best way to achieve this is by elevating the quality of the coffee.

2. Refined Coffee, Not Sugar

You can't elevate the quality of sugar—refined sugar is the same at Dunkin, Luckin, or Starbucks. After elevWhat Starbucks can refine is the quality of the coffee in its drinks. By focusing on exclusivity and quality, the brand can position itself as a luxury good rather than a normal commodity. This will help justify Starbucks' pricing even in a downward-turning market.

Follow the yellow hexagons - that’s glucose in the blood. It either gets used by muscles, or turned into fat. I still remember a few things from my college biochemistry classes.

Starbucks should also slim down its menu, by reducing sugary drinks. It's wrong to offer beverages with 60 grams of sugar (I don’t care if it’s profitable) when obesity and diabetes are exploding in the U.S. Excessive sugar, particularly in drinks, is one of the root causes of these metabolic issues. Starbucks Fraps have nearly 60 grams of sugar in a Venti. That’s insane. Ultra-endurance athletes use about 60grams of sugar in an hour of running during a marathon.

If you’re drinking a Starbucks frap and doing anything less than this, that sugar is getting turned to fat. Starbucks has gotten fat and needs to cut the sugar.

3. Simplified Customization

Starbucks currently offers around 170,000 drink combinations through its app, but this overwhelms both customers and operations. The company should reduce the number of options to focus on a core set of high-quality offerings that are easily customizable. While personalization is great for customer retention, the current system is too complex. A data-driven study could help streamline choices by identifying the most efficient ways to prepare drinks and align those with the mission of offering high-quality, low-sugar beverages. A reduction by a factor of 10 seems possible. 10,000 combinations is still a lot!

4. Franchise in China

Starbucks should franchise its stores in China. The China business is not large enough for a spin-off and has been losing market share in a highly competitive market so an IPO now of Starbuck’s China would go poorly. There are no licensed stores in China, although there are more than 10,000 licensed stores worldwide. However, the demand for franchises in China is enormous, as seen with Luckin and Cotti, both of which have grown rapidly through the franchise model.

By offering a master franchise license for the country, Starbucks should be able to maintain its luxury image and high quality while reducing the capital expenses required to open new stores.

The company can continue operating flagship stores, like the roasteries and experience-driven locations, but should franchise smaller, faster, to-go outlets in high foot-traffic areas where seating is not a priority. This would allow Starbucks to expand its presence in China while sharing the capital burden of growing at a pace similar to Luckin or Cotti.

What do you pick?

5. Faster Drinks

Long wait times are another major issue for Starbucks, as discussed in the Q2 earnings call. Customers are abandoning their orders due to long lines or delays in the app. To resolve this, Starbucks needs to reduce wait times especially during peak hours.

New CEO Brian Niccol brings experience with this, after leading implementation of 500 “Chipotlanes” at Chipotle. The Chipotlanes are a mobile-order only drive-thru line. Wait times there dropped to 12 seconds.

Starbucks can implement similar changes by:

Using ghost kitchens for to-go orders, eliminating the need for these orders to come from physical stores.

Pre-mixing major syrup blends for faster preparation, especially if the menu is streamlined.

Mobile lanes for pickup of paid-for and complete drinks, like Chipotlanes.

Splitting pickup and dine-in service, with one area dedicated to seated customers and another for to-go orders.

This could include refrigerated or heated lockers where drinks are stored and accessed through the app, as well as a counter for traditional name calling, which feels like the old cafe days of Starbucks.

This is from a pop-up Blue Bottle shop in Japan. I see versions of this in the future for Starbucks, with a prep-robot and a barista hidden from view.

The Right Blend

The board of Starbucks was right to replace Narasimhan with Niccol. The difficult thing with leading a business is that you can get two or three things right, but they may not be the most important. That matters a lot when things get tough, as they have for Starbucks.

Narasimhan was right to increase a focus on efficiency. But it shouldn’t be in how fast baristas can move behind counters - it should be on how customers get their orders from the building.

He was right to want to elevate the brand - but doing it through “a lavender platform and drink pearls” as touted in the Q2 commentary, isn’t the right call for this coffee brand. They need to elevate the coffee, not the mix-ins that can be copied by any competitor.

I like Starbucks. I think it once made really good coffee. I think it’s too sweet now. Hopefully Brian Niccol can put the company on a diet and give the brand room to grow fast in China through outside dollars.

I’m betting this isn’t the Siren’s last song, just a bump in the road.

Until next week!

-Nate

2 quick notes.

I had a great summer. I hope you did too! We went back to the states from Japan to visit family. I caught a bunch of fish with my kids. My brother got married. It was awesome.

But now I’m back and ready to help small businesses create really good strategies that help them win.

I only have 4 openings for the fall consulting cohort. It’s a split of consulting and coaching and runs for 12 weeks. We get a lot done together.

Click here to set up a free discovery call.

I launched a new course for small business owners showing how you to use AI to increase profitability. It’s a high impact, short course to help you reduce expenses and find ways to increase revenue. Learn more here.